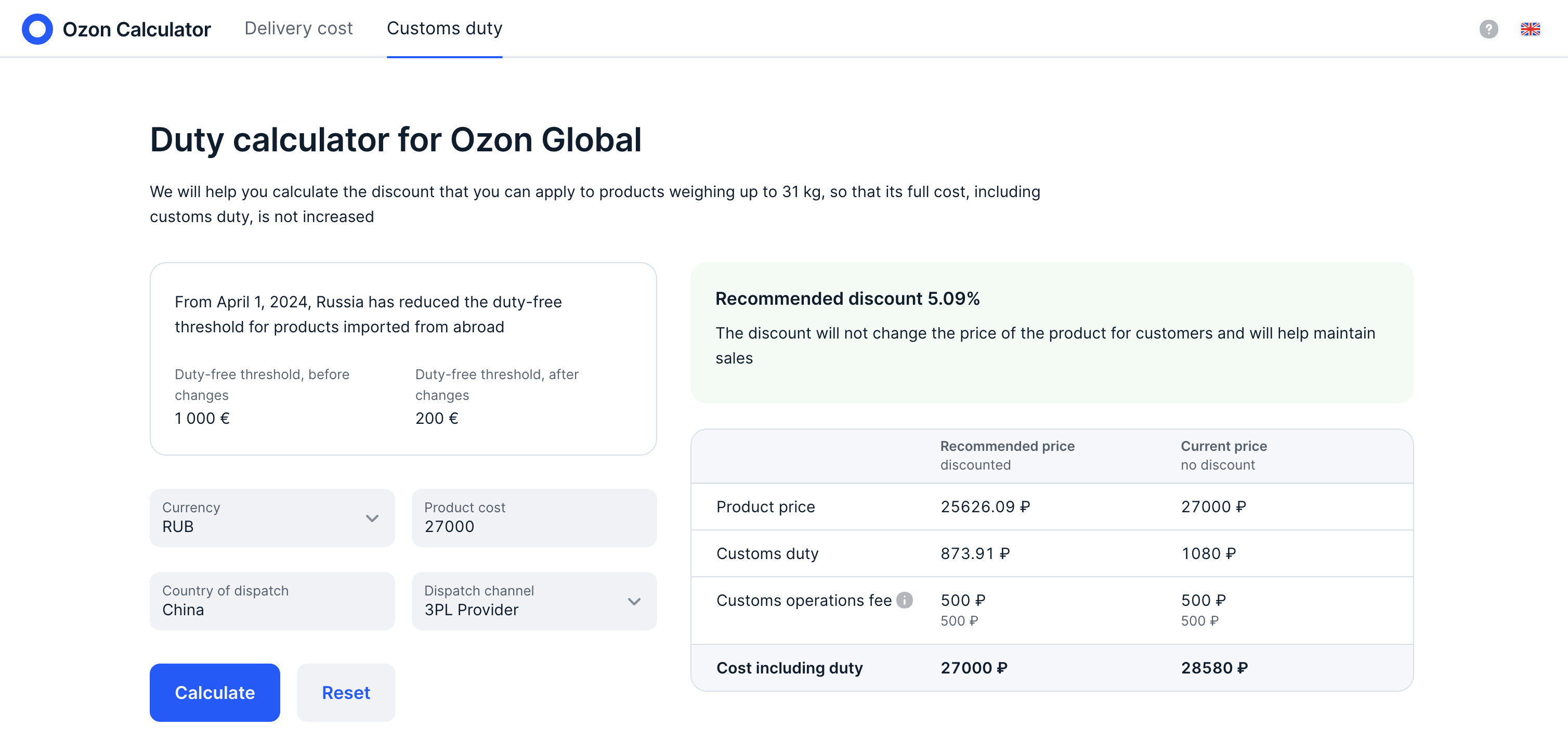

Products imported into Russia are subject to customs duty if they cost over 200 euros or weigh over 31 kg.

If the parcel exceeds the duty-free import threshold, the customer must pay the customs duty when the products pass customs control or upon receipt at the post office.

The customs payment includes:

- customs duty: 15% of the excess amount;

- customs charge: 500 rubles;

- commission fee paid to the customs agent: 2–3%.

To keep the product competitive with the new duty-free threshold, you can offer customers a discount that adjusts the product price.

Use our calculator to find out an amount of the discount you can set to keep the product price the same. The calculator only works for products weighing up to 31 kg.

Notifying customers #

We notify customers about the customs payment so you don’t have to warn them.

The customers are notified about the customs payment:

-

When they view the PDP and add a product to the cart.

-

When the product passes customs, if it’s sent to the pick-up point or delivered by courier:

-

we send a push notification, a text message, and an email;

-

we display information about the customs payment and a payment link in the customer’s personal account.

-